- Webinar

- ► On-Demand

Ripjar Sanctions Masterclass

Watch Ripjar and FINTRAIL’s sanctions masterclass to discover best practices and evolving techniques to optimise your sanctions screening.

- Whitepaper

Guide to Adverse Media Screening

Download your guide to adverse media screening best practices, tailored to your role within your organisation.

- Whitepaper

GenAI Trends in Financial Crime Compliance

Find out how compliance managers are integrating generative AI, and discover the opportunities and challenges of this transformative technology.

- Webinar

- ► On-Demand

Beyond Fuzzy Matching: The Future of Name Screening

Discover how you can move beyond fuzzy matching to transform your customer screening with Ripjar’s unique approach to name matching.

- Brochure

Name Screening Brochure

In this brochure, learn more about the key features of the solution, and how they can help supercharge your name screening.

- Webinar

- ► On-Demand

How to Supercharge your Screening with Compliance Copilot

Discover how GenAI technology can be harnessed to increase the efficiency and effectiveness of 1st line compliance analysts, with Ripjar’s Compliance Copilot.

- Brochure

Compliance Copilot Brochure

Compliance Copilot supports analysts with handling alerts and assessments, providing fast, unbiased decisions and recommendations.

- Webinar

- ► On-Demand

Ripjar AI Masterclass: Secrets to Effective Adverse Media Screening

Join Ciara Aitchison (FINTRAIL), Neil Gummow (UBS), plus Ripjar’s Gabriel Hopkins and Abhijith Rajan as they explore the secrets to effective adverse media screening.

- Whitepaper

APAC Compliance Landscape 2024

In this guide, explore the evolving regulatory landscape in the Asia Pacific (APAC) region, and discover the current trends, challenges and developments.

- Whitepaper

The GenAI Playbook

for Compliance Officers

Discover how GenAI can be used to transform anti-financial crime processes, exploring use cases, risks, and practical tips on its safe use and implementation.

- Webinar

- ► On-Demand

Emerging Threats, Evolving Solutions:

Join our expert panel as they discuss the current challenges in cybersecurity and the latest threat investigation trends and solutions.

- Whitepaper

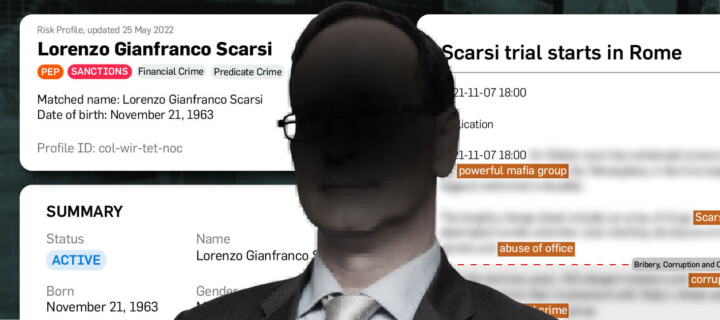

2023 - 2024 State of Adverse Media Screening

This report presents the key findings from the survey, outlining 2023-2024’s top adverse media screening trends, industry stats and insights.

- Webinar

- ► On-Demand

Revealing Hidden Customer Risk with Adverse Media

In this webinar, moderated by The Dark Money Files’ Ray Blake, the panel discusses the opportunities and challenges faced by banks and financial institutions when it comes to implementing robust customer screening processes.

This report follows a recent roundtable discussion with compliance professionals from a range of UK banks and financial institutions. It outlines the ways in which they’re currently using adverse media screening, the challenges they face in the screening process, and the ways in which technology can be used to cut through the noise and uncover true risk levels.

This report gives an overview of the global regulatory landscape around negative news screening, while focusing on specific jurisdictions in greater detail. It looks at risks and opportunities and analyses emerging regulatory trends, giving actionable recommendations and best practices for FIs seeking to keep on top of upcoming regulations.

- Webinar

- ► On-Demand

Getting the balance right with your adverse media screening

Ripjar's CEO, Jeremy Annis and CPO Gabriel Hopkins discuss Adverse Media Screening in depth.

- Whitepaper

Chief Compliance Officer's Playbook

This paper serves as a practical guide for CCOs, who are looking to maximise the impact of their role and stay ahead of emerging industry trends.

- Whitepaper

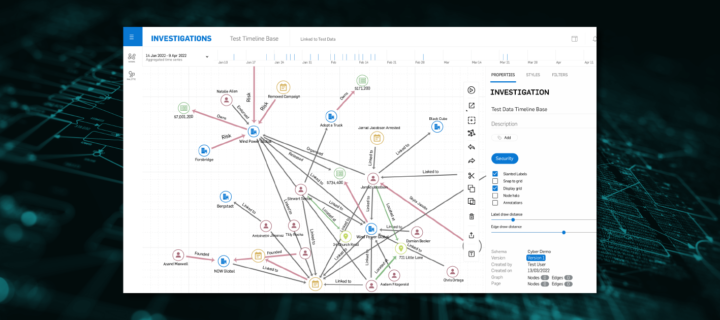

The Future of Financial Crime Investigations

This white paper explores the pressing technological needs of financial crime investigators within internal financial intelligence units (FIUs), by highlighting the unique opportunities and challenges they face.

- Whitepaper

Adverse Media Trends 2022

Artificial Intelligence and Machine Learning, Focus on effectiveness, The emergence of new risks and issues, Financial inclusion and elimination of bias, Expanding the scope of Adverse Media Screening

- Whitepaper

Adverse Media Screening Guide

The following guide condenses what Ripjar has learned into immediately usable tips and ideas that any financial services provider can benefit from as we collectively try to optimise our use of adverse media and get the best possible outcomes and return on investment.

- Whitepaper

Global Illumination of Financial Crime

Ripjar’s Client Screening solution allows the continual screening of millions of clients against a million news providers and all known Sanctions and Watchlist entities in near real-time.

- Video

Introducing Labyrinth

Cybercrime, money laundering, fraud, terrorism - Ripjar Labyrinth allows organisations to build solutions to fuse data, automate analytics, and orchestrate workflows to solve some of the world's most challenging problems.

- Whitepaper

Client Screening: A Next Generation Approach

In this white paper, we discuss Ripjar's next generation approach to client screening that uses artificial intelligence to continuously monitor all clients for risk in real time.

- Datasheet

A New Approach to Client Screening

Ripjar presents a next-generation financial time capability that uses machine learning to automatically identify client risk across al data sources in real-time.

- Datasheet

Labyrinth Datasheet

An unprecedented toolkit for fusing, analysing and orchestrating data analysis at scale.

- Datasheet

Secure By Design

Ripjar's platform - Labyrinth - is built to maintain a customer's security requirements under the strictest financial and government security environments.

Ready to get started?

Get in touch to discuss how we can enhance your business